Full guide to cash flow from financing activities Bloom Group S A.

The highlighted region is where you would find the cash flow from financing activities. This increase in the importance of cash flows is primarily due to the increasing use of the discounted cash flow method (DCF) to evaluate companies and assets. Cash from financing activities represents the source or way a company raises capital and covers the return of the capital raised to the investors.

Then recalculate operating cash flow (see formula above) with the new tax figure. Basic FCF doesn’t include changes in debt, so when a company takes on new debt, basic free cash flow for that period can be misleadingly positive. Therefore, Cash flow from financing activities levered free cash flow, also known as free cash flow to equity (FCFE), can be more accurate. To help visualize each section of the cash flow statement, here’s an example of a fictional company generated using the indirect method.

Part-B Chapter 1: Overview of Computerised Accounting System

In simple words, it monitors the net change in cash related to capital raising and related activities. The next section, Section 8.6, brings together the complete statement of cash flows, using the direct method. In the example used in Section 8.3 and 8.4, the financing section included one transaction related to equity, and which decreased cash, for a total net cash flow from financing of $50000. Negative Cash Flow from investing activities means that a company is investing in capital assets. As the value of these assets increases, the amount of net Cash Flow available to the company over time increases.

- However, this might signal the fact that the earnings of the company are not enough to support its operations or other plans.

- By contrast, debt and equity issuances are shown as positive inflows of cash, since the company is raising capital (i.e. cash proceeds).

- Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

- Cash flow from investing activities comprises all the transactions that involve buying and selling non-current assets, from which future economic benefits are expected.

This can include things like investing in stocks, buying and selling property, or taking out loans. Yet it’s important to remember that it’s just one metric to consider when evaluating a company. In this case, the CFF may be artificially high because the company is taking on more debt to fund its operations. Let’s say that a company’s balance sheet has long-term liabilities of $10 million at the beginning of the year and $11 million at the end of the year. Cash Flow from Financing Activities tracks the net change in cash related to raising capital (e.g. equity, debt), share repurchases, dividends, and repayment of debt.

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. Debt and equity financing are reflected in the cash flow from financing section, which varies with the different capital structures, dividend policies, or debt terms that companies may have. Cash flow from financing activities provides investors with insight into a company’s financial strength and how well a company’s capital structure is managed. Therefore, investors must study the reasons behind unusual inflows or outflows of cash from financing activities.

Why You Can Trust Finance Strategists

Rohan Arora is a member of WSO Editorial Board which helps ensure the accuracy of content across top articles on Wall Street Oasis. Free cash is the cash left over after the business has met all its obligations. It’s essential to planning future spending as it shows how much cash a business has at its disposal. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

You should check their loan activities before committing to a purchase of company stock. There is a need to compile accurate information for the income statement and balance sheet. Plus, it’s incredibly important to monitor cash flow and where it’s coming from. The cash from financing amount is added to the prior two sections — the cash from operating activities and the cash from investing activities — to arrive at the “Net Change in Cash” line item. By contrast, debt and equity issuances are shown as positive inflows of cash, since the company is raising capital (i.e. cash proceeds).

How to Calculate Cash Flow From Financing Activities

The better these details get maintained, the more accurate your accounting will be. One common misconception is that interest expense — since it is related to debt financing — appears in the cash from financing section. Note that the parentheses signify that the item is an outflow of cash (i.e. a negative number).

Understanding the cash flow allows one to understand the business better and make informed investment decisions. In simple terms, cash flow statements tell us how efficient a company is in converting its profits into real cash. Investors used to look at the income statement and balance sheet for hints about the company’s financial status. However, over time, investors have begun to independently examine each of these statements, with more importance on the cash flow figures. Subtract both the $149,000 of debt repaid and $50,000 of dividends paid to arrive at a (positive) cash flow from financing activities of $55,000. Identify whether each of the following items would appear in the operating, investing, or financing activities section of the statement of cash flows.

What is Cash Flow from Financing?

But to set yourself up for success, you’ll also need to think about your business name, finances, an operating agreement, and licenses and permits. Small businesses must have a basic understanding of this concept because it’s linked to how much money we have available to run our businesses. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

ExxonMobil announces second-quarter 2023 results – ExxonMobil

ExxonMobil announces second-quarter 2023 results.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

These items are all listed in a cash-flow statement, but can also be identified by comparing non-current assets on the balance sheet over two periods. To calculate net cash flow, simply subtract the total cash outflow by the total cash inflow. Whether you’re a manager, entrepreneur, or individual contributor, understanding how to create and leverage financial statements is essential for making sound business decisions. When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP, but sometimes in the financing section under IFRS as well. Financial activity is any activity that involves the use of money or other financial instruments to generate profits.

A review of the statements of cash flows for both companies reveals the following cash activity. Some of the most common and consistent adjustments include depreciation and amortization. To get started, create a list of all financing activities that have taken place over a certain period of time. Once you have this list, add up all of the cash inflow items and subtract all the cash outflows.

- This statement is one of the documents comprising a company’s financial statements.

- This issuance of stock is categorized as a positive change in the financing cash position of the company.

- Knowing the amount of cash a company generates and possesses and the activities it generates it from can be extremely useful in most cases.

- The sum of all three results in the net cash flow of the company for the year.

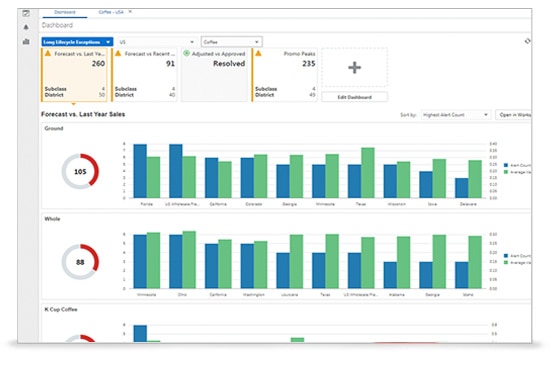

All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. No, all of our programs are 100 percent online, and available to participants regardless of their location. Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community.

Cash outflows (payments) from capital and related financing activities include:

This will reveal the total cash flow from financing activities for the period in question. Cash flow from financing (CFF) is the cash that a company generates from its financing activities. This includes activities such as issuing new debt, repaying debt, and issuing new equity. Net cash flow is the difference between all the company’s cash inflows and cash outflows in a given period. The change in net cash for the period is equal to the sum of cash flows from operating, investing, and financing activities. This value shows the total amount of cash a company gained or lost during the reporting period.

If you are unsure about which financial activity to pursue, it is best to consult with a financial advisor. They can also provide guidance on risk management and how to avoid costly mistakes. Financing activities are activities that result in changes in the size and composition of the equity capital and borrowings of the entity. Investors and analyst will use the following formula and calculation to determine if a business is on sound financial footing.

You can calculate the cash flow from financing activities by looking at a company’s balance sheet. To do this, take the beginning and ending balances of long-term liabilities and short-term liabilities. As well as the change in equity (issuance of new equity minus repurchase of equity), and subtract dividends paid. Therefore, any notable change in the cash flow from financing should be probed by investors. Also, it is essential to check the other sections of the cash flow statement, such as cash flow from operating and investing activities, as these also depict a company’s financial health.

The financing activities section shows a total of $16.3 billion was spent on activities related to debt and equity financing. The cash flow from operating activities measures the cash inflow from products and services and outflow to support the production and operations. The cash flow from financing activities measures generated cash from its financing activities. They can see this when reviewing financial statements, such as a balance sheet and income statement. Cash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends.

Recent Comments